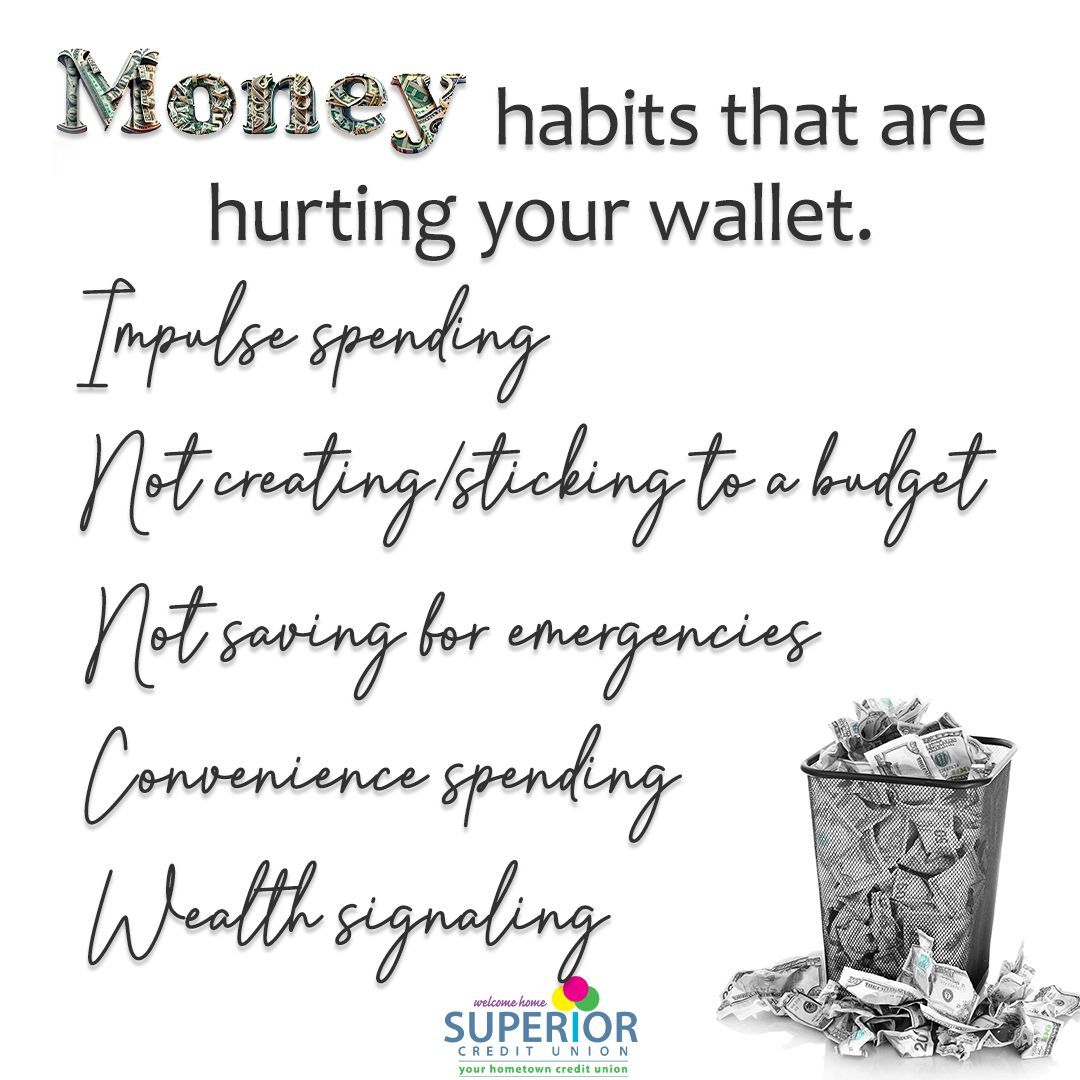

Every single day Americans spend money. So often we spend without even realizing it, slowly building up bad habits. Before we know it, we are drowning in debt and have no idea how we got there. Here are five bad habits we are all guilty of that land us in debt every time.

Impulse Spending Impulse spending is the kryptonite for a lot of people, and it can quickly get out of hand. The quick rise of online shopping during COVID has made this habit much easier to get in to.

The Solution: The first thing we can do to avoid impulse spending is simply walk away. We need to pledge to ourselves that we will wait 2 weeks, and if we still feel we need it, then we can buy it. After developing the ability to walk away, we will find quickly that the things we needed before, aren't that critical now.

Not creating (or sticking to) a budget Creating a budget forces us to take a look at our expenses and income in a very "black and white" manner. The act of creating a budget offers us an opportunity to be held accountable for the financial choices we make, and better yet, gives us the power to change those choices in almost a contractual way. Without this (or with a budget that we don't stick to), there are no rules to adhere to, so like a kid in a candy store, we can get out of hand with spending pretty quickly (and often).

The Solution: Create a budget and stick to it! Seriously, it's that easy. If we create any type of budget and put a little effort into adhering to it, we can start the process of changing bad habits.

Not Saving for Emergencies Some of us are one crisis away from bankruptcy, and unfortunately that is due to poor habits. Emergencies don't come often, and we fall into a false sense of security that leave us unprepared when things do happen.

The Solution: Start a plan where a certain portion of all income goes to an emergency fund. If we can move it to that fund before we even get to touch it, even better. Direct deposit splits are our best friend for something like this.

Convenience Spending This is probably the single most dangerous bad habit that we ALL have. Life is busy, and almost every day we pay more for something because it is easily accessible. The convenience store down the street has milk, but it might be 3 dollars more than the grocery store.

The Solution: We get into this bad habit mostly because spending the 'right' way is much harder. Takeout is easier than cooking. Wawa is easier than the grocery store. So the solution will be more difficult as well. Enable the 'waiting period' on convenience purchases to see if they are truly necessary. Examine all purchases under $10 to see if they can be bought or made cheaper.

Wealth Signaling 'Keeping up with the Joneses" is a habit ingrained in a lot of us today. Wealth signaling is the concept of having nice things because it shows others your value or status in life. The problem is, when we see someone with the newest car we don't see the massive car payment, or the lack of savings from the down payment. Wealth signaling is two-dimensional, therefore does not actually represent a person's innate worth.

The Solution: We need to focus on ourselves and our own personal definition of success. Is it being debt free, or having a pre-owned car that is 100% paid off? Realizing that our value comes from things other than the objects we own free us up to spend our money much more wisely.