Understanding the Power of Attorney: What It Is and Why It Matters

At Superior Credit Union, we often assist members who present a Power of Attorney (POA) document — but we’ve found that many people are unclear about what a POA actually means, how it works, and why it’s so important to have one in place.

Simply put, a Power of Attorney is a legal document that authorizes a designated person (known as the agent) to act on behalf of another person (the principal). The agent can make financial, legal, or even health-related decisions for the principal, depending on the type of POA that has been created.

A Common Misunderstanding About POAs

One of the biggest misconceptions about a POA is that it only comes into effect when the principal is no longer capable of making decisions. In fact, in many cases, the opposite is true. A general Power of Attorney actually terminates when the principal becomes incapacitated, unless it is specifically made durable.

This is why understanding the different types of POAs — and how they work — is crucial.

Sometimes a POA can be both springing and durable: triggered by a specific event, and lasting throughout the principal’s life after activation.

Types of Power of Attorney

A POA can be tailored to fit a variety of situations and needs. Here are a few key types:

Durable Power of Attorney: This type remains effective even if the principal becomes incapacitated. It continues throughout the principal’s lifetime unless revoked.

Springing Power of Attorney: This POA only becomes effective after a specific event occurs — typically when the principal becomes incapacitated or otherwise unable to manage their affairs.

Real-Life Examples:

Jane and John: Jane is traveling abroad for two years and wants her son John to manage her financial affairs while she is away. She creates a springing POA that begins when she leaves the country and ends when she returns.

Dave and Sarah: Dave, an 87-year-old showing signs of dementia, wants to appoint his granddaughter Sarah to manage his financial responsibilities. He creates a durable POA, effective immediately, which will continue even if he becomes unable to make decisions himself.

General vs. Limited Power of Attorney

The scope of authority given to the agent can also vary:

General POA: Grants broad powers, allowing the agent to act on a wide range of financial and legal matters on behalf of the principal.

Limited POA: Restricts the agent’s authority to specific tasks, time periods, or situations.

In Jane’s case, her POA is limited — John’s authority only covers managing her finances while she’s out of the country. Meanwhile, Sarah holds a general POA, allowing her to handle all of Dave’s financial matters.

Setting Up a Power of Attorney

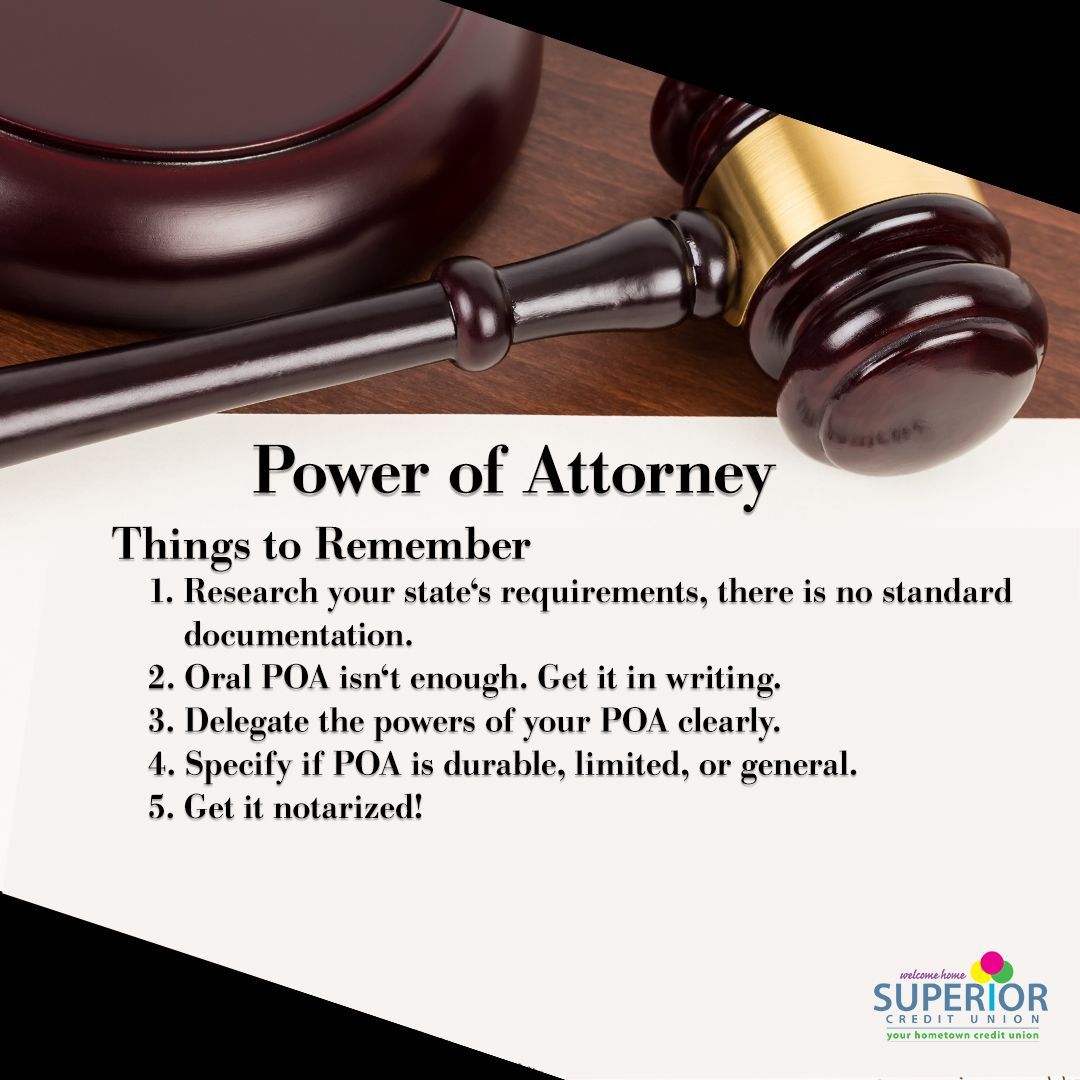

If you are considering setting up a POA, keep these important points in mind:

- Follow your state’s legal requirements: Each state has its own laws regarding POAs, so be sure to research the necessary forms and regulations.

- Clearly define the agent’s powers: Be specific about what the agent can and cannot do, and clearly describe any triggering events if it’s a springing POA.

- Put it in writing and notarize it: A verbal agreement is not enough. Having a written and notarized POA provides legal protection for everyone involved and ensures that your agent can act swiftly and effectively on your behalf.

Final Thoughts...

Having a Power of Attorney in place can offer tremendous peace of mind — both for you and for those you trust to act on your behalf. Whether you're planning for the unexpected or simply need someone to manage your affairs while you're away, a POA is a powerful tool to help protect your interests and ensure your wishes are honored.

If you have questions about how a Power of Attorney might impact your financial relationship with Superior Credit Union, our team is always here to help guide you!